Beyond the Pandemic: More Reasons to Change.

A new research conducted by PWC has exposed that, for the past five years (2017-2023), car makers have prolonged the start of production in at least half more than what was scheduled. Delays, as defined by PWC, relate to any date which surpasses the one originally planned for production launch. A good illustration would include the Buick Envista project – an automobile which has been held up several times during development. This deferment doesn’t just refer to entirely new models, but also applies to facelifts and platform amendments.

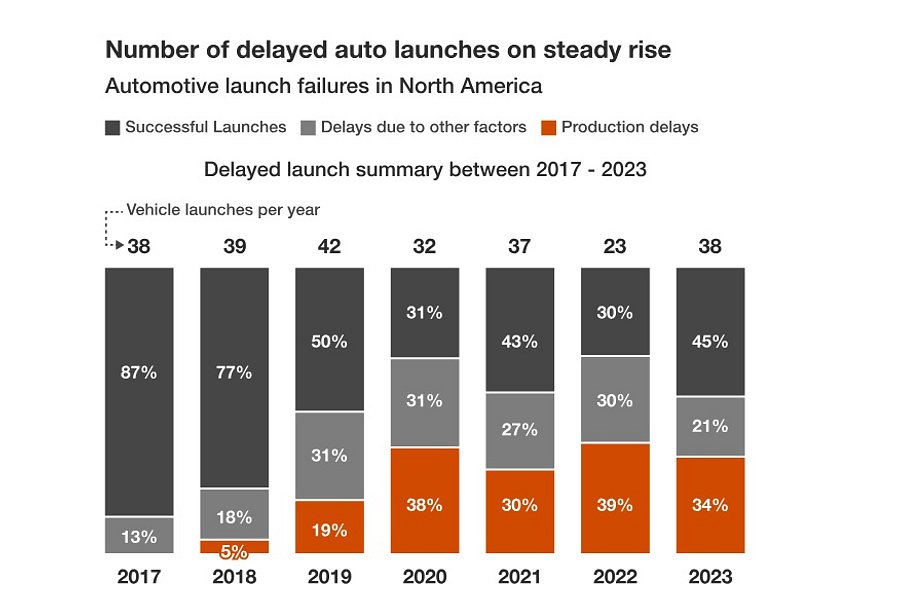

As shown on the graph below, the amount of launches that were late in 2017 was only 13%. Then, in the subsequent years, we have been noting times when production either lagged or other issues caused postponements. All in all, there was a 23% delay rate for 2018, and in 2019, the automotive sphere fell way behind with 50% . However, it had an even worse outcome the following year due to Covid-19; where 69% ended up past deadline. Nevertheless, statistically there was an improvement in 2021, as 57% defied their delay rate. But then in 2022, a shocking percentage of 69% missed on their goals. And currently, the situation is looking brighter with 55% succeeding their expected due date.

PWC recently uncovered the actual reasons behind production delays, and not surprisingly, their findings are quite obvious. Supply chain obstacles remain undeniably present (not simply semiconductor chips, but many other components) combined with the standards of excellence expected by everyone, alongside limited personnel, have all led to problems in expanding production. Electric vehicle elements were extremely noted as a major problem.

“Other” factors, such as portfolio changes, are causing delays in the production of electric cars. Though usually a straightforward task, transitioning to electric cars presents new challenges that manufacturers are not used to dealing with. An example of this is the Ford F-150 Lightning, which is based on the same platform as the Internal Combustion Engine (ICE) F-150 but experienced delays nonetheless.

A further difficulty materialized concerning the initiation period. The implementation of every auto anticipated to begin in 2020 had to be deferred because of industrial plant closures. Lastly, consumer inclination and objectives have moved considerably.

In financial terms, a twelve-month postponement could involve up to $200 million in loss for a manufacturer. For instance, various vehicles were set back for 2023 due to the causes mentioned above.

Examples may include the Chevrolet Equinox, the Mazda CX-70 and the Corvette Z06. As a result of an unwarranted wait of a year, The Chevy Silverado EV is expected to experience the greatest extent of repercussions.

“According to a recent report, the North American automotive industry could suffer losses of anywhere between 2-7% of its total value, amounting to $30-50 billion annually, should launches be delayed. This would be a significant blow to the industry,” the report stated.

A considerable alteration of the non-monetary implications could be even more difficult to traverse. Not only standings between vehicle manufacturers and customers can be defiled, but timescale disruptions can also affect other arrangements manufacturers hold with suppliers. If Chevrolet is unable to release their electric truck as planned, suppliers producing its infotainment systems, tires, windscreen wipers etc. would be adversely impacted too. A sequence reaction in the entire industry could be triggered.

The presence of such problems can lead to diminishing staff morale, interrupted quality control, and a heightened danger in terms of technological outdating. This was made evident with the Mazda MX-30’s into a market that had already seen development from its opponents, coming with less than adequate range specifications. As a result, this electric vehicle barely endured past twelve months of being on sale.

The most severe danger to any business is the opportunity for its competitors to gain an edge, resulting in a decline in market share. A timely example of this struggle is the release of the Equinox EV. Its launch was postponed by the UAW strike, thus forcing Chevrolet to abandon their goal of selling the vehicle at $30k. They spoke often and proudly about this low price point, however it has left them with a smudge on their reputation which gave rivals like Tesla and their upgraded Model 3 a chance to bridge the gap. With cars as unconventional and luxurious as the Bentley Continental GT or Porsche 911 GT3, people are prepared to wait, but usually not an ordinary electric SUV.

It is predicted by PwC that the count of novel electric vehicles will multiply over the next 5 years, up to 2026. There could potentially be a postponement of 20%-40%, dependent on if automakers are able to reconcile the problems detailed in this article.